Risk Management Courses

All Subjects > Management > Risk Management

Learn professional risk management practices, tools and more with online courses from the New York Institute of Finance and other top schools and institutions.

Related topics - Accounting | Analytics | Business Administration | Business Analysis | Business Analytics | Cash Flow Analysis | Corporate Finance | Data Analysis | Data Analytics | Financial Analysis | Investing | Luxury Management | Stocks

What is Risk Management?

Risk management is the process of minimizing threats to the goals of an organization. Threats can come from many areas including finance issues, cyber attacks, legal issues, natural disasters, competitors, human resource problems and more. The risk manager must identify, assess and determine how best to mitigate each of these threats through a careful and well-developed risk management process.

Online Risk Management Courses and Programs

Risks to a business or organization can come in many forms. The key is to know what to look for and understand the events, actions or other things that can lead to potential threats. A good place to start is with an introductory course in risk analysis and management that teaches you how to distinguish between different types of risk and develop a risk management plan. The New York Institute of Finance (NYIF) offers a self-paced risk management training program that teaches student how to differentiate between financial and business risks, two of the major types of risk addressed in operational risk management. Learn fundamental enterprise risk management concepts and techniques as they apply to financial and business management and optionally go further to complete a professional certificate in risk management.

A common risk that businesses of all types face are threats to the successful completion of projects. A self-paced project risk assessment course is a good place to learn how to address these risks. The in-depth program from the University of Michigan teaches students how to use statistics to measure different components of project risk and to compare the value of different projects after adjusting for differences in their risks.

Additional programs and courses available include financial risk management, cybersecurity risk management, credit risk management and legal risk management. Enroll now to start learning more about this exciting, in-demand field.

Jobs in Risk Management

No organization is completely immune to risk. The presence of financial, business, cyber and other risks mean that companies must invest in employees to address them. The demand is high for risk analysts, risk modelers, IT risk managers and many related positions. A search on Indeed.com resulted in over 6,000 open, full-time positions in the field of risk management with estimated salaries ranging from $65K to $130K per year. Experts are needed in the areas of risk identification, risk assessment, risk control and risk mitigation. As you can imagine, the banking and securities industries invest heavily in financial risk managers and the top companies hiring include JP Morgan Chase, Wells Fargo, Morgan Stanley, Citibank and Goldman Sachs.

Explore a Career in Risk Management

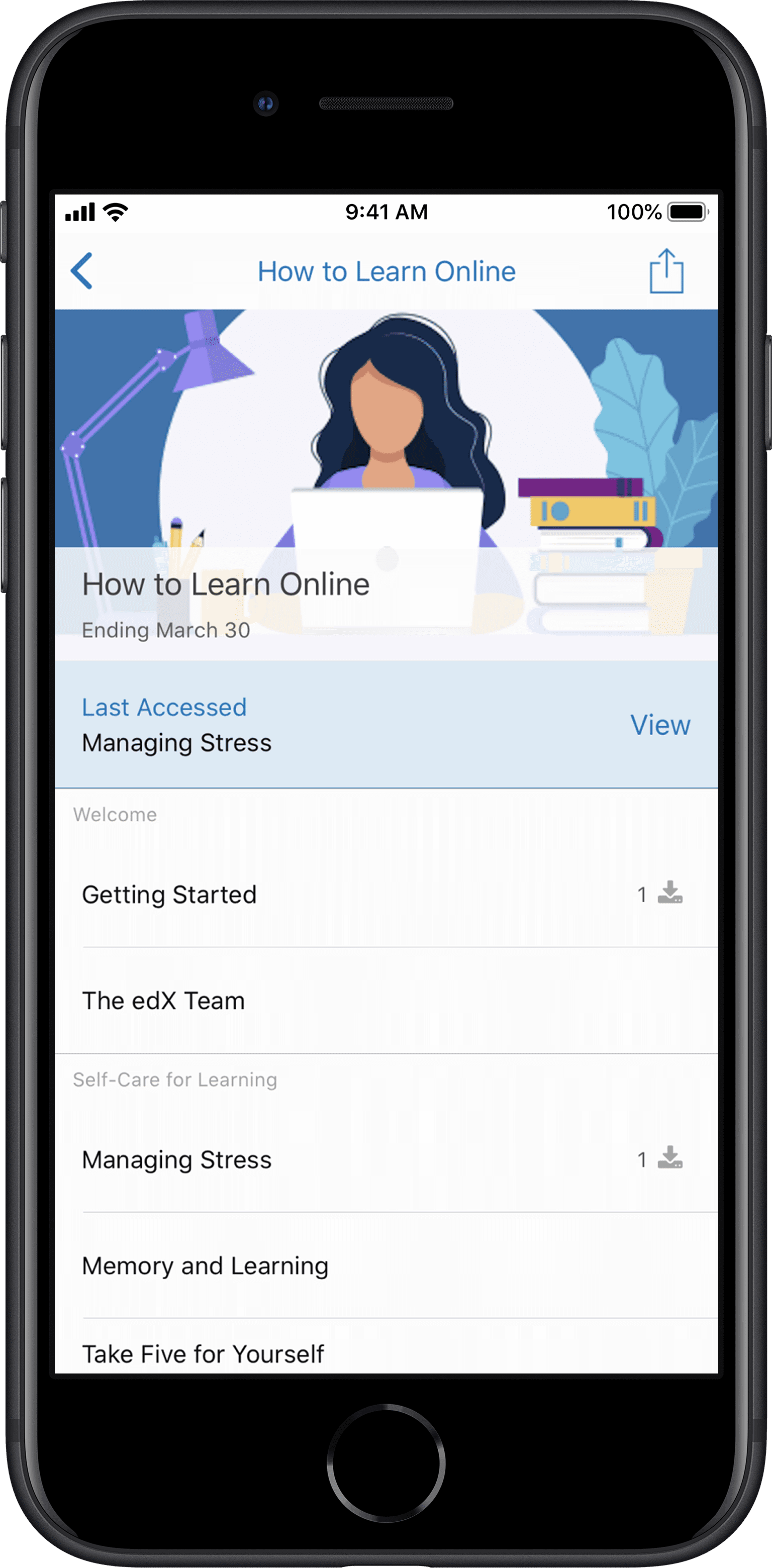

Earn a professional certificate in risk management online and get started on a path to a lucrative career in this in-demand field. Many of the online courses in risk management on edX are self-paced so you can enroll and start learning today.